The Financial Platform for Smart Players

Instant access.5 Earn cash back. No strings attached. Your gaming account stays separate, secure, and fully under your control.

Instant access.5 Earn cash back. No strings attached. Your gaming account stays separate, secure, and fully under your control.

Instant access.5 Earn cash back. No strings attached. Your gaming account stays separate, secure, and fully under your control.

Instant access.5 Earn cash back. No strings attached. Your gaming account stays separate, secure, and fully under your control.

In Partnership With

Your Bank Blocks Bets. EDGE Boost Doesn’t.

EDGE Boost is a smarter way to fund your play.

Other Financial Platforms

Blocked deposits

Multiple accounts to track

High fees & minimums

Low transaction limits

Limited compatibility

Delays in fund availability

Gaming transactions typically don’t earn rewards, cash back, or incentives

Converting crypto to USD usually requires multiple steps, separate platforms, and additional setup.

With EDGE Boost

With EDGE Boost

24/7/365 transfers

Accepted at licensed US gaming locations.4

FDIC-insured accounts (up to $250K).3

No fees, no minimums

Optimized for seamless gaming transactions

Accelerated weekend liquidity

Earn up to 0.5% on qualified online iCasinos, SportsBooks, DFS, Horse Racing, and Arcades.2

[Coming Soon] Link approved crypto wallets and instantly convert BTC, ETH, and stablecoins to USD

Your Bank Blocks Bets. EDGE Boost Doesn’t.

EDGE Boost is a smarter way to fund your play. No declined cards, no high-interest credit, and no bank judgment.

Other Financial Platforms

Blocked deposits

Multiple accounts to track

High fees & minimums

Low transaction limits

Limited compatibility

Delays in fund availability

Gaming transactions typically don’t earn rewards, cash back, or incentives

Converting crypto to USD usually requires multiple steps, separate platforms, and additional setup.

With EDGE Boost

With EDGE Boost

24/7/365 transfers

Accepted at licensed US gaming locations.4

FDIC-insured accounts (up to $250K).3

No fees, no minimums

Optimized for seamless gaming transactions

Accelerated weekend liquidity

Earn up to 0.5% on qualified online iCasinos, SportsBooks, DFS, Horse Racing, and Arcades.2

[Coming Soon] Link approved crypto wallets and instantly convert BTC, ETH, and stablecoins to USD

Your Bank Blocks Bets.

EDGE Boost Doesn’t.

EDGE Boost is a smarter way to fund your play.

Other Financial Platforms

Blocked deposits

Multiple accounts to track

High fees & minimums

Low transaction limits

Limited compatibility

Delays in fund availability

Gaming transactions typically don’t earn rewards, cash back, or incentives

Converting crypto to USD usually requires multiple steps, separate platforms, and additional setup.

With EDGE Boost

With EDGE Boost

24/7/365 transfers

Accepted at licensed US gaming locations.4

FDIC-insured accounts (up to $250K).3

No fees, no minimums

Optimized for seamless gaming transactions

Accelerated weekend liquidity

Earn up to 0.5% on qualified online iCasinos, SportsBooks, DFS, Horse Racing, and Arcades.2

[Coming Soon] Link approved crypto wallets and instantly convert BTC, ETH, and stablecoins to USD

Your Bank Blocks Bets.

EDGE Boost Doesn’t.

EDGE Boost is a smarter way to fund your play.

Other Financial Platforms

Blocked deposits

Multiple accounts to track

High fees & minimums

Low transaction limits

Limited compatibility

Delays in fund availability

Gaming transactions typically don’t earn rewards, cash back, or incentives

Converting crypto to USD usually requires multiple steps, separate platforms, and additional setup.

With EDGE Boost

With EDGE Boost

24/7/365 transfers

Accepted at licensed US gaming locations.4

FDIC-insured accounts (up to $250K).3

No fees, no minimums

Optimized for seamless gaming transactions

Accelerated weekend liquidity

Earn up to 0.5% on qualified online iCasinos, SportsBooks, DFS, Horse Racing, and Arcades.2

[Coming Soon] Link approved crypto wallets and instantly convert BTC, ETH, and stablecoins to USD

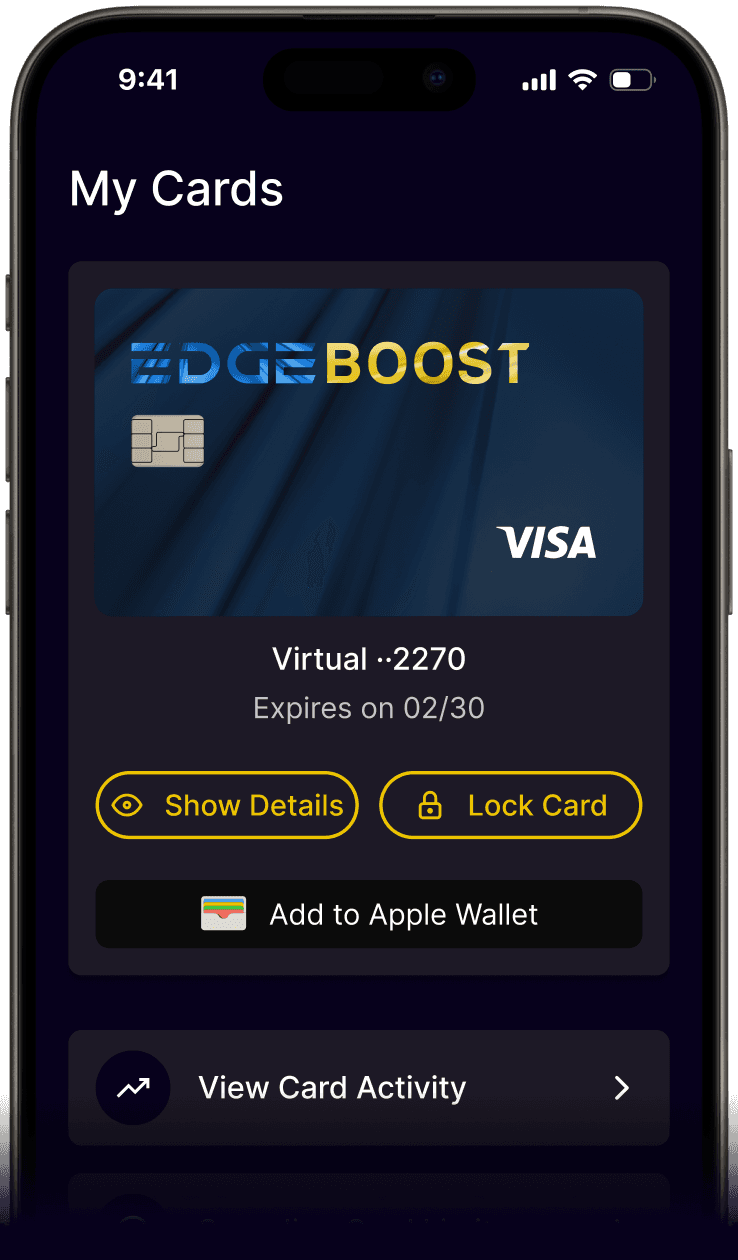

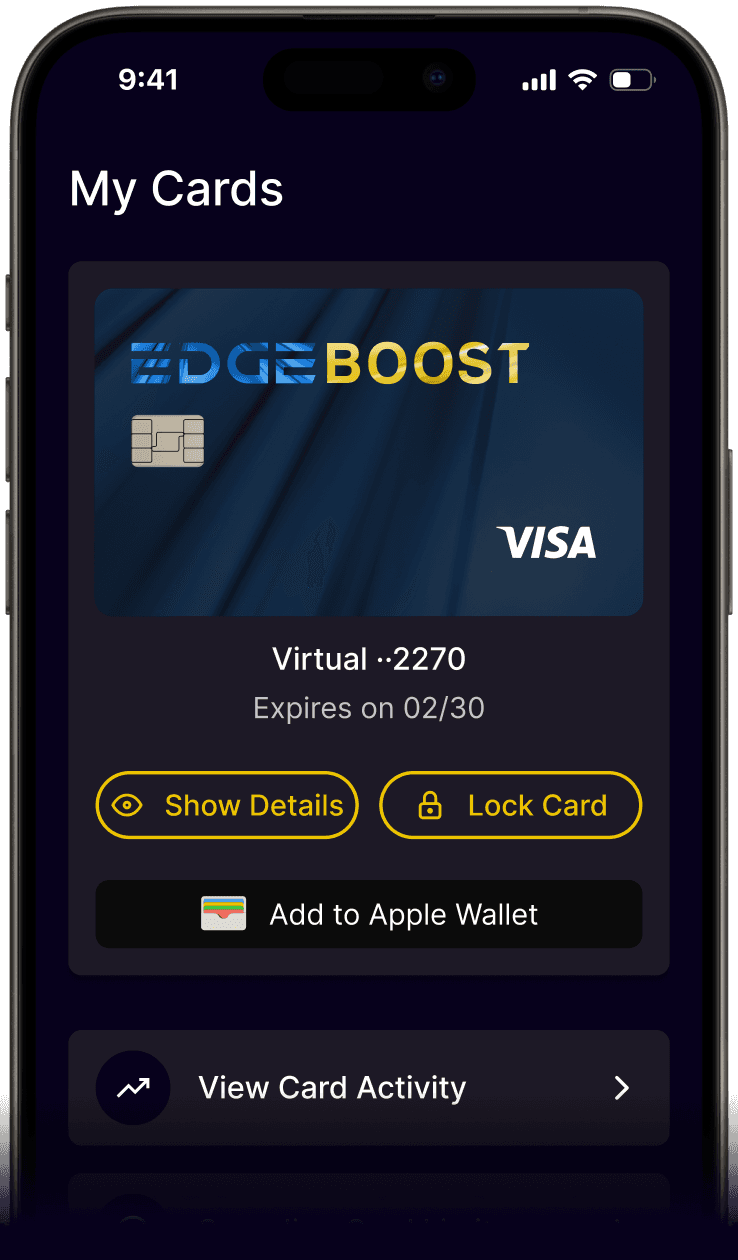

Holistic Gaming Account Features

Track your spending, manage your card, set limits, and get rewarded. All from one simple, secure app.

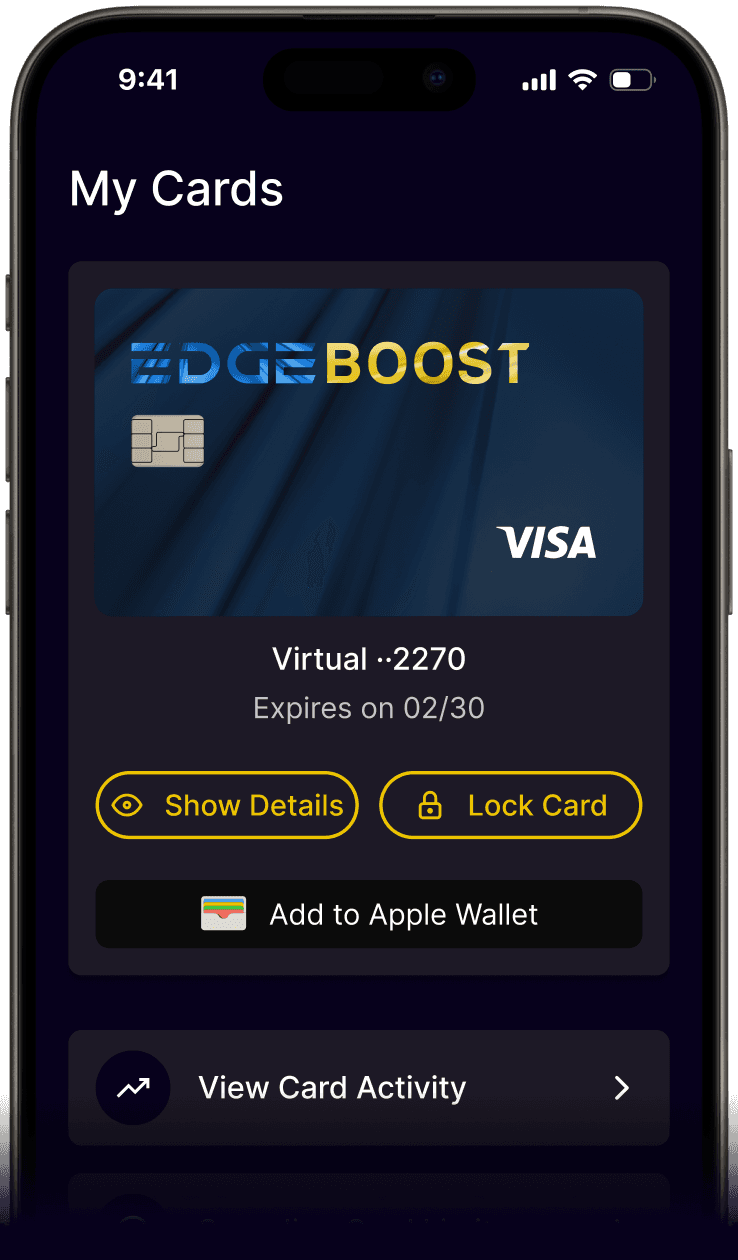

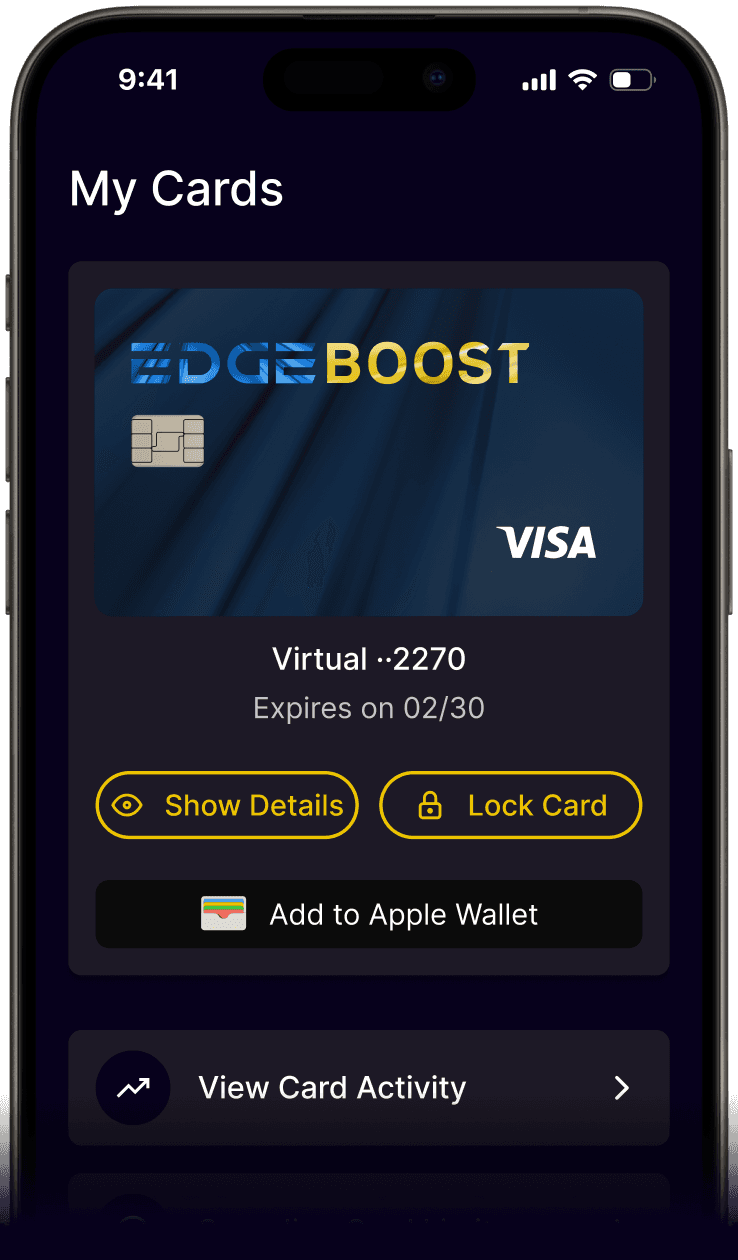

Your Card, Always Ready

Open the app and access your EDGE Boost Visa card instantly.

Quick, Easy Deposits

Deposit fiat or crypto in seconds and fund your account your way.

Your Money, Live

Check your balance instantly and track spending in real time.

Instant Reward Insights

View your Cash Back and perks in real time, all in one place.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

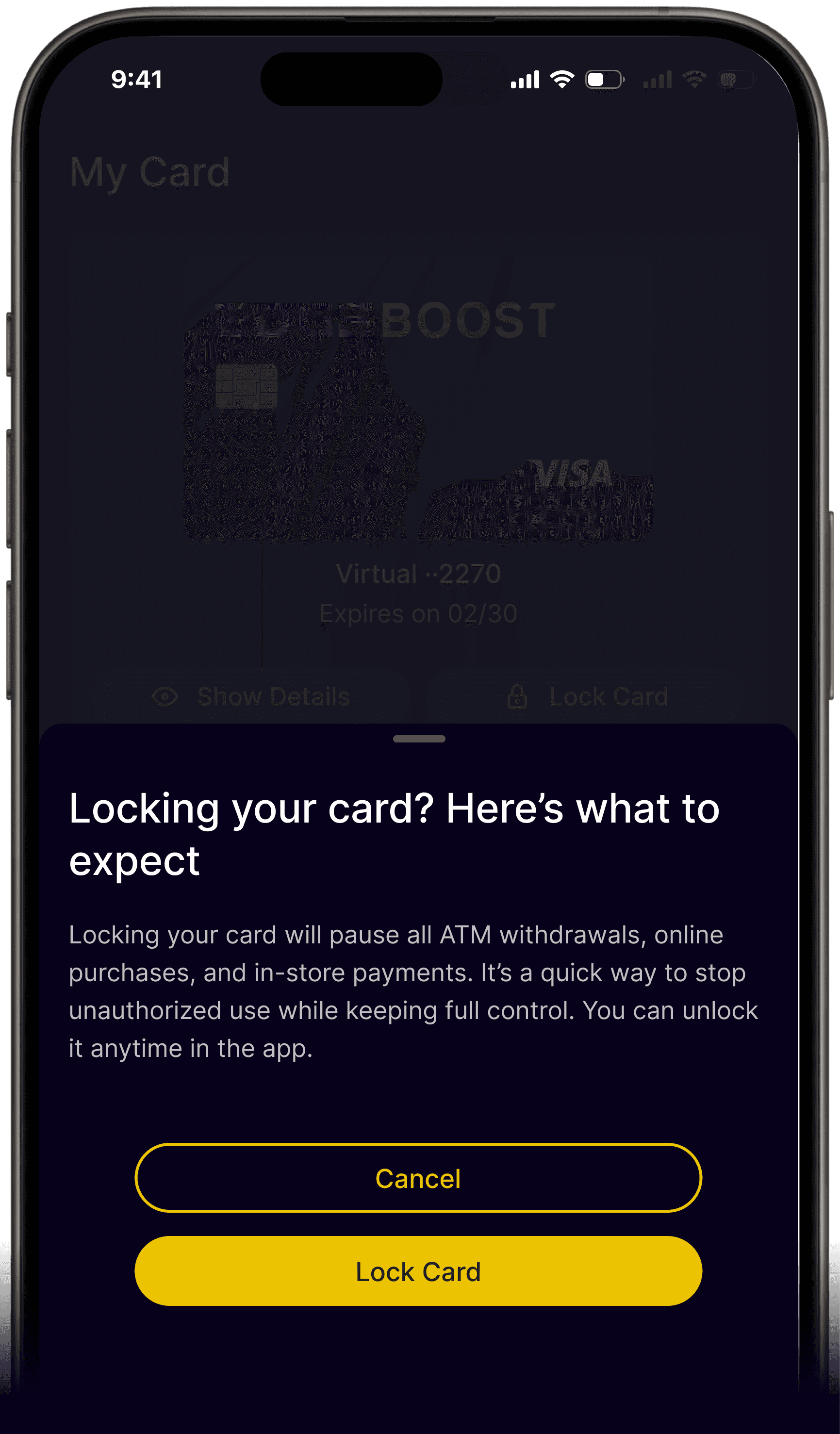

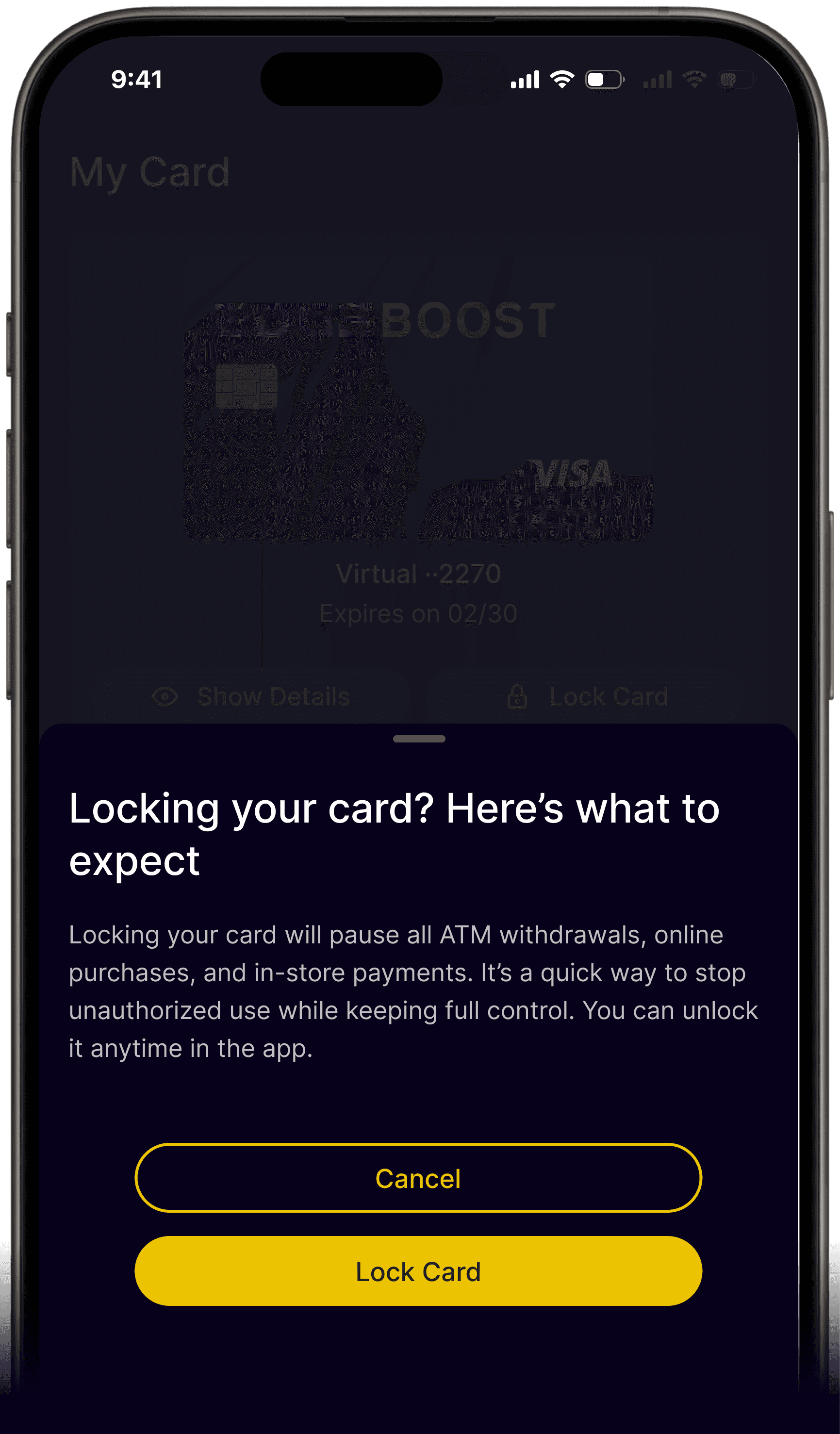

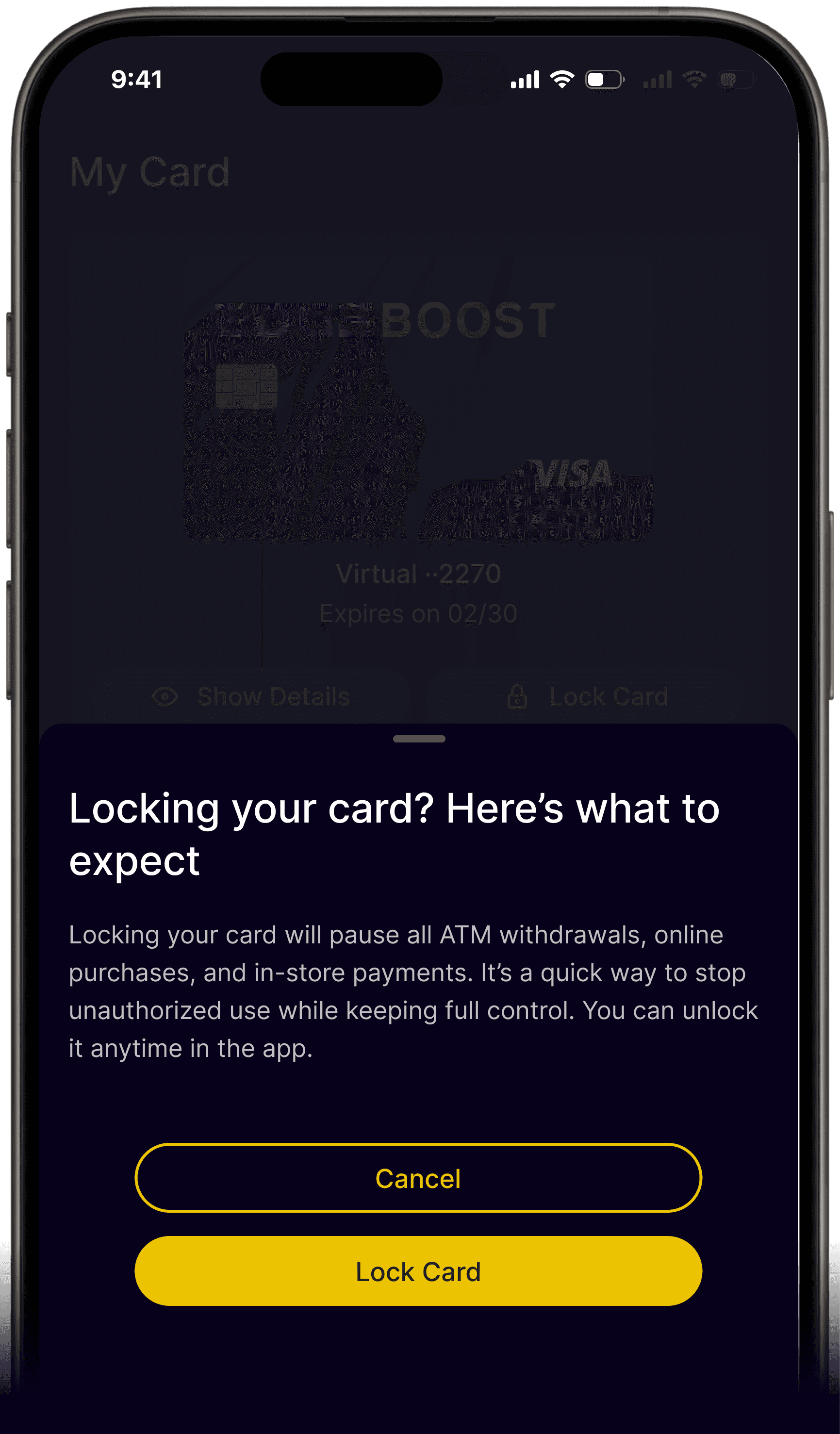

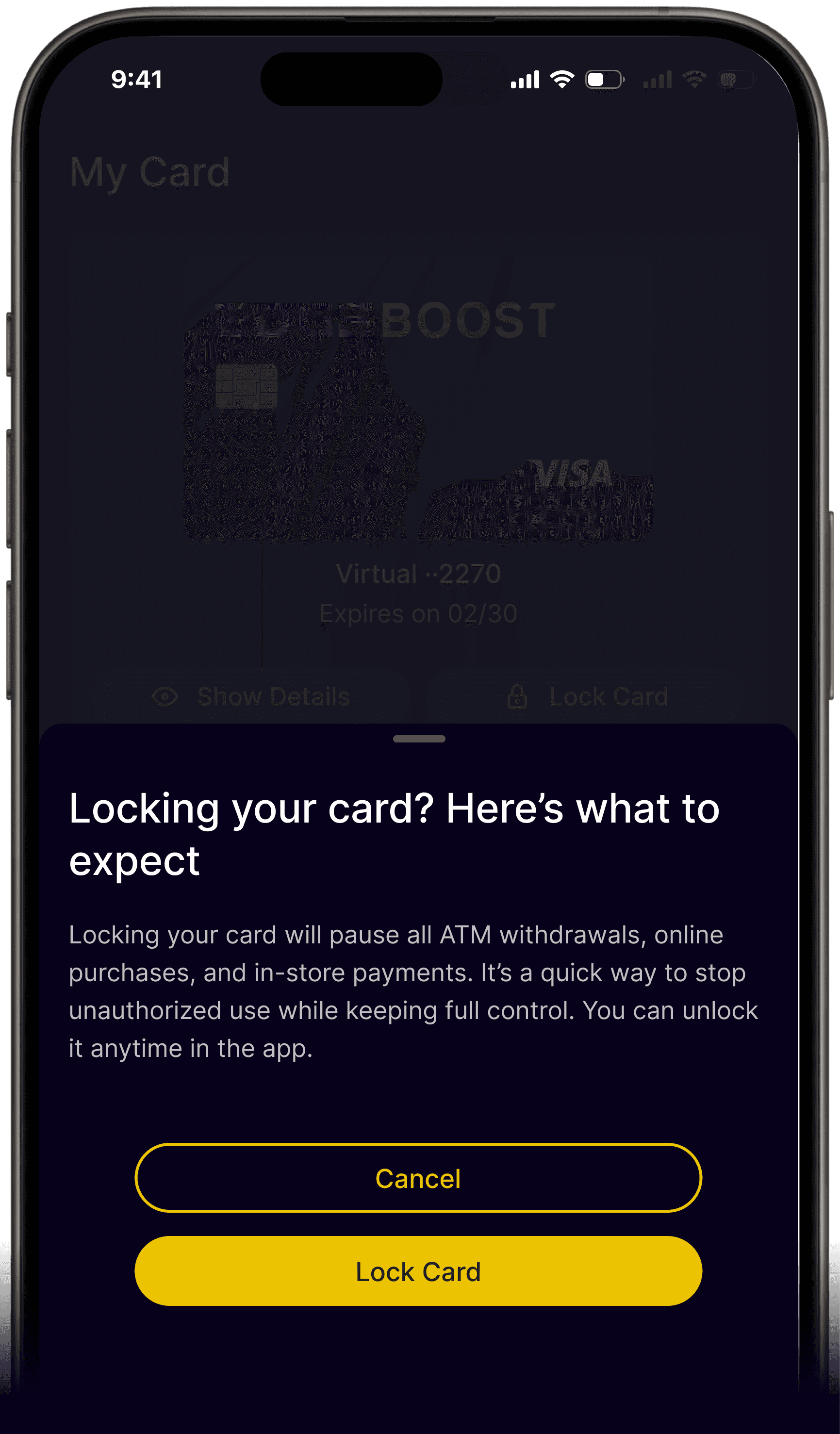

Total Card Control

Manage your card with ease, including instant freeze and unfreeze.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

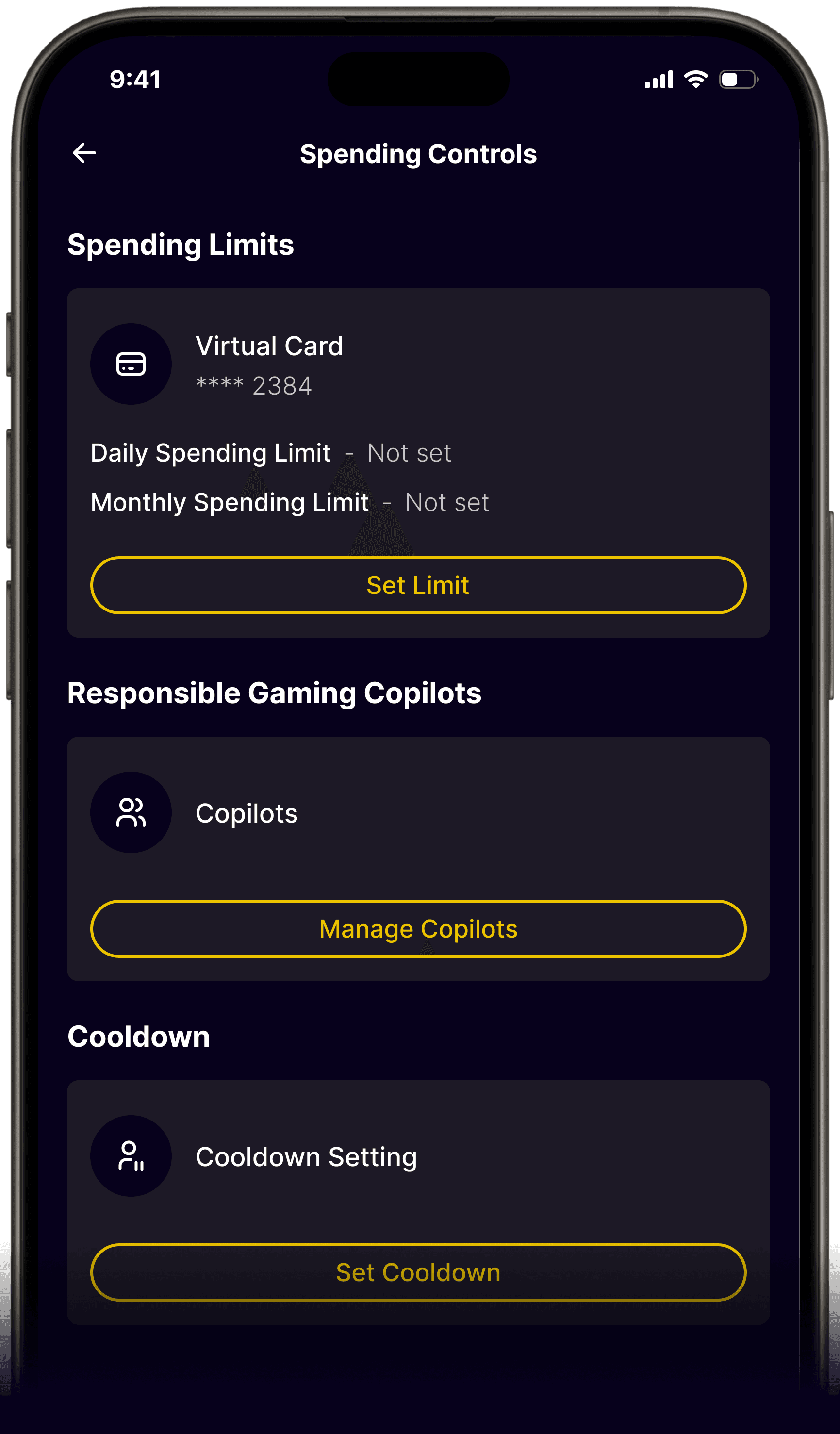

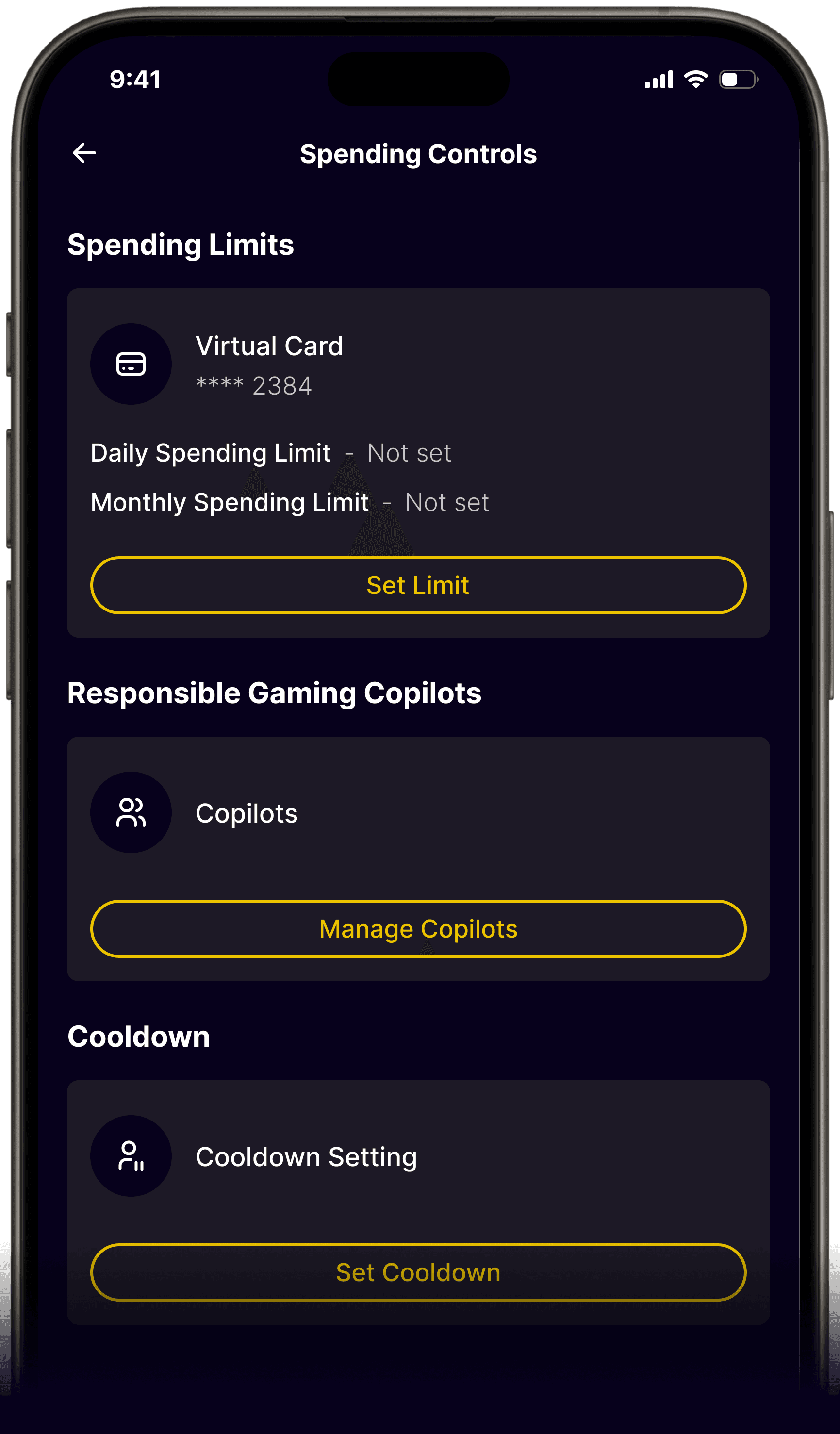

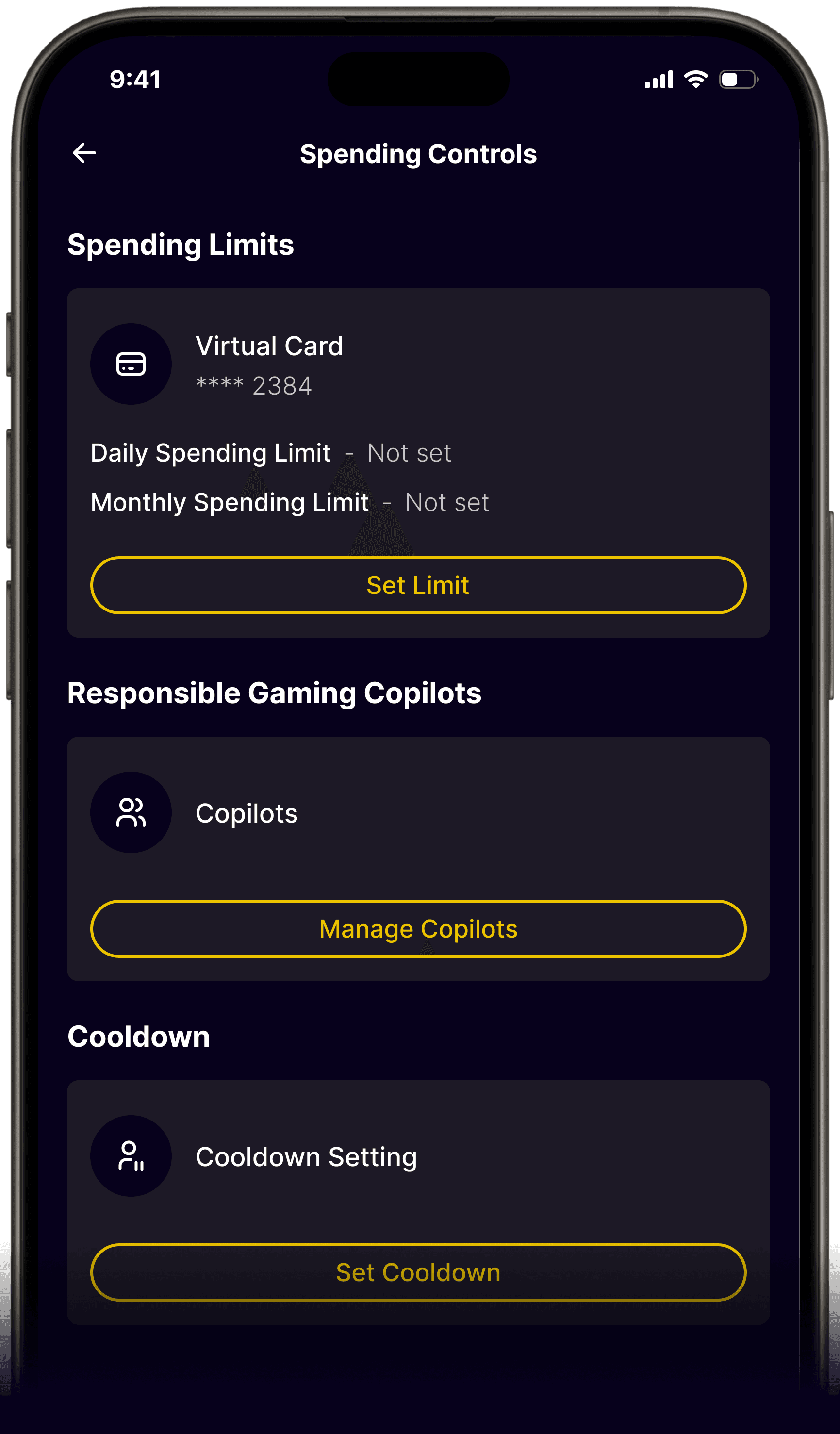

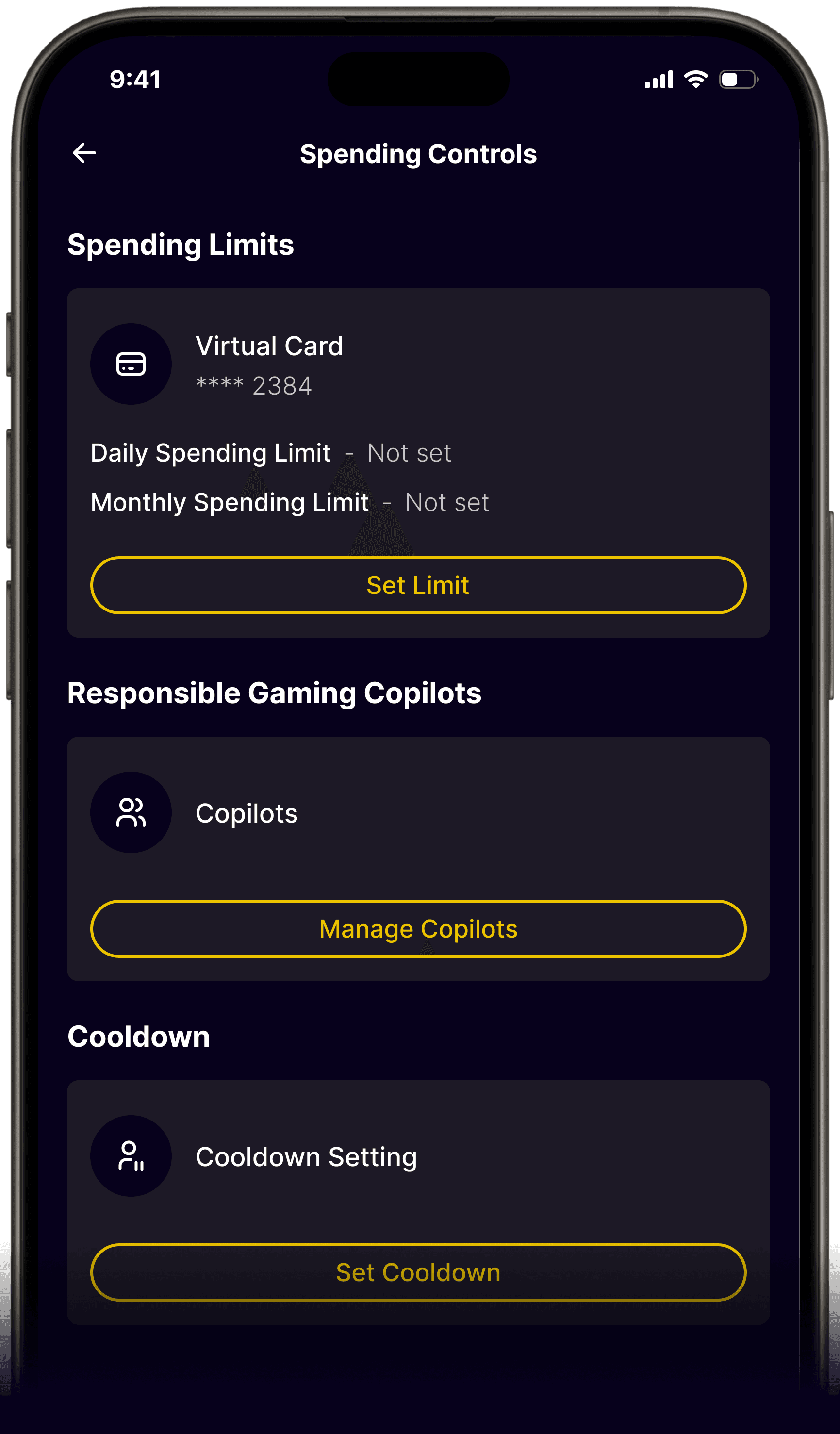

Tools for Healthy Play

Easily set spending limits and breaks to keep your gaming in check.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Holistic Gaming Account Features

Track your spending, manage your card, set limits, and get rewarded. All from one simple, secure app.

Your Card, Always Ready

Open the app and access your EDGE Boost Visa card instantly.

Quick, Easy Deposits

Deposit fiat or crypto in seconds and fund your account your way.

Your Money, Live

Check your balance instantly and track spending in real time.

Instant Reward Insights

View your Cash Back and perks in real time, all in one place.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Total Card Control

Manage your card with ease, including instant freeze and unfreeze.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Tools for Healthy Play

Easily set spending limits and breaks to keep your gaming in check.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Holistic Gaming Account Features

Track your spending, manage your card, set limits, and get rewarded. All from one simple, secure app.

Your Card, Always Ready

Open the app and access your EDGE Boost Visa card instantly.

Quick, Easy Deposits

Deposit fiat or crypto in seconds and fund your account your way.

Your Money, Live

Check your balance instantly and track spending in real time.

Instant Reward Insights

View your Cash Back and perks in real time, all in one place.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Total Card Control

Manage your card with ease, including instant freeze and unfreeze.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Tools for Healthy Play

Easily set spending limits and breaks to keep your gaming in check.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Holistic Gaming Account Features

Track your spending, manage your card, set limits, and get rewarded. All from one simple, secure app.

Your Card, Always Ready

Open the app and access your EDGE Boost Visa card instantly.

Quick, Easy Deposits

Deposit fiat or crypto in seconds and fund your account your way.

Your Money, Live

Check your balance instantly and track spending in real time.

Instant Reward Insights

View your Cash Back and perks in real time, all in one place.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Total Card Control

Manage your card with ease, including instant freeze and unfreeze.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

Tools for Healthy Play

Easily set spending limits and breaks to keep your gaming in check.

9:41

My Cards

Virtual ··2270

Expires on 02/30

Show Details

Lock Card

Add to Apple Wallet

View Card Activity

Spending Card Limits

Get the most of EDGE

Your money is always safe

Order physical card

Home

Cards

Chat

Account

FDIC-Insured, Credit-Safe Protection

EDGE Boost deposit accounts are held at Cross River Bank, Member FDIC, and are insured up to $250,000 per depositor. The EDGE Boost Visa® Debit Card is issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.1

FDIC-Insured, Credit-Safe Protection

EDGE Boost deposit accounts are held at Cross River Bank, Member FDIC, and are insured up to $250,000 per depositor. The EDGE Boost Visa® Debit Card is issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.1

FDIC-Insured, Credit-Safe Protection

EDGE Boost deposit accounts are held at Cross River Bank, Member FDIC, and are insured up to $250,000 per depositor. The EDGE Boost Visa® Debit Card is issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.1

FDIC-Insured, Credit-Safe Protection

EDGE Boost deposit accounts are held at Cross River Bank, Member FDIC, and are insured up to $250,000 per depositor. The EDGE Boost Visa® Debit Card is issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.1

Tools to Help You Play Responsibly

EDGE Boost gives you simple, effective tools to manage limits, cooldowns, and shared oversight — all focused on your well-being

For specialized treatment from the comfort of your home, connect with our partner Birches Health by clicking here, calling (833) 483-3838, or emailing help@bircheshealth.com.

EDGE Boost gives you simple, effective tools to manage limits, cooldowns, and shared oversight — all focused on your well-being

For specialized treatment from the comfort of your home, connect with our partner Birches Health by clicking here, calling (833) 483-3838, or emailing help@bircheshealth.com.

Responsible Gaming

Responsible Gaming

Set spending card limits to stay in control of how much you play across all your accounts in all 50 states

Responsible Gaming

Responsible Gaming

Set spending card limits to stay in control of how much you play across all your accounts in all 50 states

Responsible Gaming

Responsible Gaming

Take a break anytime with a cooldown period that pauses your account for up to 30 days

Responsible Gaming

Responsible Gaming

Take a break anytime with a cooldown period that pauses your account for up to 30 days

Responsible Gaming

Responsible Gaming

Set a copilot and keep yourself accountable by sharing updates with someone you trust

Responsible Gaming

Responsible Gaming

Set a copilot and keep yourself accountable by sharing updates with someone you trust

Used by Smart Players Across the U.S

“As someone using EDGE Boost for the past two months, I've deposited $1.2M using the card and earned $6K in cash back. I can confidently say that EDGE Boost is a trustworthy and valuable product that's a must-have for anyone who enjoys sports betting or gaming.”

Phill Hellmuth

EDGE Boost Ambassador

"It has also been fantastic to have a dedicated account to track my bankroll and budget my funds. This allows me to practice proper bankroll management and play responsibly."

Lexy Gavin-Mather

EDGE Boost Ambassador

Used by Smart Players Across the U.S

“As someone using EDGE Boost for the past two months, I've deposited $1.2M using the card and earned $6K in cash back. I can confidently say that EDGE Boost is a trustworthy and valuable product that's a must-have for anyone who enjoys sports betting or gaming.”

Phill Hellmuth

EDGE Boost Ambassador

"It has also been fantastic to have a dedicated account to track my bankroll and budget my funds. This allows me to practice proper bankroll management and play responsibly."

Lexy Gavin-Mather

EDGE Boost Ambassador

Used by Smart Players Across the U.S

“As someone using EDGE Boost for the past two months, I've deposited $1.2M using the card and earned $6K in cash back. I can confidently say that EDGE Boost is a trustworthy and valuable product that's a must-have for anyone who enjoys sports betting or gaming.”

Phill Hellmuth

EDGE Boost Ambassador

"It has also been fantastic to have a dedicated account to track my bankroll and budget my funds. This allows me to practice proper bankroll management and play responsibly."

Lexy Gavin-Mather

EDGE Boost Ambassador

Used by Smart Players Across the U.S

“As someone using EDGE Boost for the past two months, I've deposited $1.2M using the card and earned $6K in cash back. I can confidently say that EDGE Boost is a trustworthy and valuable product that's a must-have for anyone who enjoys sports betting or gaming.”

Phill Hellmuth

EDGE Boost Ambassador

"It has also been fantastic to have a dedicated account to track my bankroll and budget my funds. This allows me to practice proper bankroll management and play responsibly."

Lexy Gavin-Mather

EDGE Boost Ambassador

VIP

VIP

Unlock the EDGE Boost VIP Experience

As an EDGE Boost VIP, access elite limits, premium rewards, priority processing, balance bonuses, and more.

VIP

VIP

Unlock the EDGE Boost VIP Experience

As an EDGE Boost VIP, access elite limits, premium rewards, priority processing, balance bonuses, and more.

VIP

VIP

Unlock the EDGE Boost VIP Experience

As an EDGE Boost VIP, access elite limits, premium rewards, priority processing, balance bonuses, and more.

VIP

VIP

Unlock the EDGE Boost VIP Experience

As an EDGE Boost VIP, access elite limits, premium rewards, priority processing, balance bonuses, and more.

Used Across the Betting World

Used Across the Betting World

Used Across the Betting World

Start Using

EDGE Boost Today

Start Using

EDGE Boost Today

Start Using

EDGE Boost Today

Start Using

EDGE Boost Today